Fast Track to Funding: Hard Money Lenders Atlanta GA Can Gas Your Success

Fast Track to Funding: Hard Money Lenders Atlanta GA Can Gas Your Success

Blog Article

Unlocking the Secrets of Hard Cash Lenders in Real Estate

Browsing the world of tough cash lenders in genuine estate can be a strange trip for many financiers and designers. Comprehending the detailed workings of these financial partners is important for those seeking alternative resources of funding. From the nuanced requirements for funding authorization to the approaches for fostering successful partnerships, the globe of tough cash offering holds a treasure of understandings waiting to be revealed - hard money lenders atlanta ga. As we peel off back the layers of this enigmatic landscape, we will certainly clarify the concealed treasures that might potentially transform your property ventures.

The Basics of Tough Cash Financing

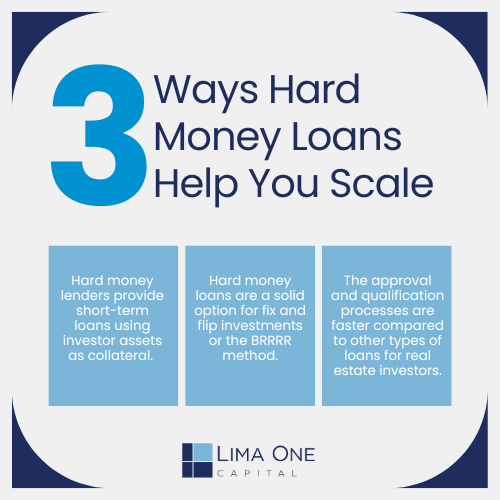

Difficult cash loans are asset-based finances secured by genuine building, making them a popular option for genuine estate capitalists seeking quick financing or those that might not qualify for conventional bank financings due to credit report issues. Unlike conventional fundings, tough cash lending institutions concentrate much more on the value of the residential property being made use of as security instead than the borrower's creditworthiness.

Rate of interest rates for tough money car loans are higher than typical home mortgages, typically ranging from 7% to 15%, mirroring the boosted risk for the loan provider. Understanding these standard principles of tough cash lending is critical for financiers looking to leverage this funding option properly in genuine estate endeavors.

Pros and Disadvantages of Hard Cash Car Loans

Nevertheless, there are downsides to take into consideration when deciding for a tough cash lending. These fundings usually feature greater rates of interest and costs contrasted to standard funding choices, potentially enhancing the general cost of the investment. Additionally, the reasonably brief payment periods connected with hard cash loans can tax debtors to sell or refinance promptly, affecting their monetary planning and possibly causing higher risks if the property does not market as expected. While tough cash car loans offer advantages, investors have to thoroughly weigh the expenses and risks prior to deciding to pursue this funding path.

Just How to Get Approved For Hard Money

What standards do difficult cash loan providers generally take helpful hints into consideration when examining a customer's qualification for a finance? To qualify for a tough money loan, consumers need to offer a residential property with substantial equity, as this offers as the lender's protection in situation of default. By fulfilling these criteria, debtors can enhance their possibilities of certifying for a hard cash lending to money their real estate ventures - hard money lenders atlanta ga.

Leading Tips for Dealing With Lenders

When working together with lending institutions in property deals, keeping clear and open communication networks is essential for making sure a smooth and successful funding procedure. Openness from both events is important. Right here are some leading suggestions for working efficiently with lenders:

Be Prepared: Have all your paperwork prepared and arranged. Lenders will certainly value your expertise and preparedness.

Understand the Terms: Make sure you fully comprehend the terms of the finance, consisting of rate of interest, fees, and repayment routines. If anything is look at this website uncertain., ask inquiries.

Construct a Partnership: Developing an excellent partnership with your lending institution can lead to future opportunities. Treat them with respect and professionalism and reliability.

Meet Deadlines: Timeliness is type in real estate purchases. Guarantee you satisfy all due dates to keep the count on and self-confidence of your loan provider.

Remain in Communication: Maintain your loan provider updated on the development of the project. If any kind of problems occur, resolve them without delay and proactively.

Usual False Impressions Regarding Hard Cash

Relocating from the realm of working together with traditional lenders, it is crucial to expose prevalent misconceptions bordering difficult money funding in real estate transactions. An additional misunderstanding is that hard cash fundings are aggressive in nature due to their greater rate of interest rates. While it's real that hard cash fundings frequently have greater rate of interest rates than standard car loans, they offer a different purpose and are suggested for shorter terms, typically for genuine estate investors looking to flip homes quickly.

Final Thought

To conclude, tough money offering in realty uses a distinct financing alternative for investors looking for fast access to funds. Comprehending the essentials of hard money financings, the pros and cons, qualifications, and suggestions for collaborating with lenders are important for effective actual estate investments - hard money lenders atlanta ga. By eliminating usual misconceptions regarding tough cash, investors can make informed choices and open the possible advantages of this alternate financing alternative

Tough cash lendings are asset-based fundings safeguarded by actual residential property, making them a popular choice for genuine estate financiers seeking fast financing or those who might not certify for standard financial institution loans due to credit score concerns. Unlike standard loans, hard money lenders concentrate extra on the worth of the property being made use of as security instead than the debtor's credit reliability. By satisfying these requirements, customers can enhance their chances of qualifying for a tough cash financing to money their genuine estate ventures.

Report this page